Research Article: 2019 Vol: 23 Issue: 1

The Impact of Board Characteristics on Earnings Management in the International Oil and Gas Corporations

Hosam Alden Riyadh Al Azeez, Brawijaya University

Eko Ganis Sukoharsono, Brawijaya University

Roekhudin, Brawijaya University

Wuryan Andayani, Brawijaya University

Abstract

This study examined whether the Board Characteristics have any impact on Earnings Management among the international Oil and Gas Corporation in the world. The Board Characteristics such as (board independence, board size, board diversity, and CEO duality). This study applied a quantitative research approach, secondary data, a sample of 71 corporations were selected from Top 250 corporations for one year (2016). The findings of this study indicated that the board independence has a significant impact on the reduction of earnings management. In contrast, the board size does not have any impact on the reduction of earnings management, due the larger the board size less efficient on monitoring of the board, when there are more members on the board it is more difficult for the board members to monitor the management, While gender diversity has a significant impact on the reduction of earnings management, Finally, The CEO Duality has a significant impact on the increase of earnings management, which means the separating the functions of CEO and Chair of the Board may enhance the Board of Directors’ monitoring and control ability, and improve Directors’ information processing capacities.

Keywords

Board Independence, Board Size, Board Diversity, CEO Duality, Earning Management.

Introduction

The modern business environment is characterized by uncertainty and hazard, it was made it increasingly the complex for prediction and control the tangible and intangible factors which influence on corporate performance, at the same time the stockholders are becoming aware and more demanding, necessitating an increased sharply concentrate on managerial as well administrative professionalism and quality of service delivery. In response to the outer pressures, the corporations go into different strategic responses such as downsizing, restructuring, business process re-engineering, total quality management, benchmarking, and management by objectives etc., to refine and sustain their competitive positions (Lai & Cheng, 2003). Based on McIntyre et al. (2007) argued in this a changeable environment case; the boards will be a very important tool for the smooth functioning of corporations. Boards are predicted to practice different functions, for instance, monitoring the management to reduce the agency costs, hiring and firing of management, supply and provide access to resources, grooming CEO and as well as providing strategic direction for the corporation. Likewise, boards have a responsibility to initiate organizational change and expedite processes that support the corporate mission.

Further, the boards' role is to protect the shareholder’s interest in an increasingly competitive environment while maintaining managerial professionalism and accountability in pursuit of good corporation performance.

In other words, the responsibility of the board is quite intimidating as it attempts to discharge diverse and challenging accountability. The board should not only stop the negative management pursuit that may lead to corporate scandals or failures but also making sure that corporation acting on opportunities that improve the value and wealth of all stakeholders. To understand the function of the board, it should be recognized that boards consist of a team of individuals, who integrate their competencies and capabilities that collectively represent the pool of social capital for their corporation that is contributed towards performing the governance function (Carpenter & Westphal, 2001). Moreover, as a strategic resource, the board is in charge of to promote and select creative options in the advancement of the corporation. Given the increasing magnitude of boards, it is important to identify the board characteristics that make one board more functional from another. Aspects of board characteristics have gained major consideration globally, especially after waves of company outrages and the disappointments of some major companies globally. The collapse of these enterprises has highlighted the limited role acted by the respective boards through a let-down of corporate governance processes. Each wave of corporate scandals over the years has reignited the recent debate on corporate governance. For example, in 1990, the financial crisis in Asia exposed weak checks and balances and governance practices. This led to focus on insider trading (Redzuan, 2012). The second wave of outrages exhibited by boards was at the onset of the new millennium involving companies like WorldCom (USA), Enron (USA), Parmalat (Italy), and Air New Zealand (Australia). According to France & Carney (2002); Lockhart (2004), they reported that the collapse of these firms brought to the fore the failure of the governance process, and this contributed to the emphasis on board composition. Later, in 2008, the financial meltdown that was triggered by the collapse of major firms globally led to the attention on administrative wage and board independence. This heightened anxiety for accountability, controlling, transparency and which led to the firm and board governance/effectiveness especially among big firm issues all over the world.

Beyond corporate failures there have been other developments that have contributed to the renewed focus on corporate boards, heightened dissatisfactions by shareholders due to poor corporate performance, falling share value have led to questions being raised on the notch of competency of the management. The phenomenal growth exhibited by corporate investors, mutual and pension funds has also increased focus on corporate boards. These established investors have the expertise to perform fiduciary responsibility of monitoring board so as to ensure good returns (Becht et al., 2005). Additional factor that has led to increased focus on board characteristics is the increasing recognition whereby a considerate executive team is a basis of the asset in different forms including; promoting venture, improve share development as well as the provision of healthier long-run stakeholder return (Lee, 2001; Carlson, 2003) cited from Redzuan (2012). According to Healy in (2003) pointed out it is now recognized that good corporate practices are a source of economic growth. In the midst of each of these corporate scandals, there is an attribute of the effectiveness of boards of directors. The series of corporate accounting scandals were witnessed at the beginnings of the 21st century across Europe and the United States and this includes several examples like Enron, WorldCom, and Xerox. It is revealed that the essence of these scandals was generally the phenomenon of earnings management (Goncharov, 2005). Managers always aim to secure all the funds needed to keep the business running so that no external party can interfere, and at the same time managers aim to gain whatever kind of benefit they can from the business (Kim & Yoon, 2009). Since the accounting earnings are of great importance to the stakeholders given the fact that it’s the end product of the accounting process and based on the many problems and acts by the managers to try practicing earnings management, stakeholders doubt the credibility and reliability of the financial reports (Uwuigbe et al., 2015).

In spite of all the instruments implemented in the last decade which intent to enhance the level of transparency, dependability and confidence in the content of the financial aspect, the ability of corporation to manipulate financial reports through the earnings management practice still occurred predominantly since these management practices are legal and within the flexibility allowed by the accounting standards which differ greatly from illegal practices and that are categorized as cases of cheat (Yildirim, 2016). Furthermore, Abdulrahman & Ali (2006) reported that earnings management practice adheres with Accounting Principles, so the practice falls within the bounds of accepted manipulations of accounting procedures and this differentiates earnings management from fraud as no violation for the rules took place. However, this practice leads to inaccurate information about the corporation.

Earnings management is determined by Blom (2009) as a purposeful interference by the management in the procedure of financial reporting in order to gain a personal benefit or for the organization. Based on this definition earnings management is not informative for shareholders, and therefore it's opportunistic. Earnings management practice is explained by several theories, According to the agency theory earnings is considered the indicator to the capital market to test whether the firm engaged in value-adding activities during a certain period or not (Waweru & Riro, 2013). While the stakeholder's theory expounds that managers may manipulate in earnings in order to enhance their personal interests and benefits at the expenditure of shareholders and additionally the remnant of stakeholders (Prior et al., 2008). The agency theory explains the agency problem which is due to the agent (management) acting in their own benefit and in an opportunistic way on the expenditure of the principal (owners/shareholders), as proposed by (Jensen & Meckling, 1976).

In today’s globalized ever-changing and competitive business landscape, thus the corporate boards have become critical for the smooth operation of organizations more than ever boards are expected to perform not just the monitoring of management but provide strategic directions especially in times of crisis (Lawler et al., 2002). Additionally, the board is also charged with the responsibility of facilitating changes that support the mission of the organization (Bairathi, 2009). For the board to execute its functions effectively, scholars concur on the importance of a competent board that contributes to the sustainability of the firm by Carpenter & Wesphal (2001); Carter & Lorsch (2003); Leblanc & Gillies (2005). Therefore, given the value of the board, it is vital to identify and assess their characteristics and the impact of on earnings management.

The governments and host communities have ways of intervening in with the affairs of corporations. In some other situation, the corporate owners and managers intentionally embark on acts that render more of self than the overall well-being of the affected corporations. A priori weak business culture and poor corporate governance are eligible for creating incentives for the appointment of wrong and dubious people into corporations’ boards if whether or not a board structure comprising such people boost corporate performance has continued an issue of empirical and theoretical debate. It is exceedingly accepted that the composition of the corporate board could play a pivotal role in determining corporate performance. The international oil and gas corporations represent a good situation for exploring the board constituted under subjective circumstances serve or can fail to serve firm’s interests; and whether such transmits to the overall wellbeing of shareholders. This study sets to exploring the relationship which is examining the impact of board characteristics (board independence, board size, board diversity, and CEO duality) on the earnings management (Sanda et al., 2008). The board independence refers to “the degree to which board members are dependent on the current CEO or organization.” Independent nonexclusive directors are outside directors as opposed to either insider, who are managers or employees of the firm directors or dependent non-executive directors, who have personal and/or professional relationships with the firm other than board membership is the proportion of independent non-executive directors on the board is viewed as a major factor influencing financial performance in particular Independent non-executive directors. The focus on board independence is grounded in the agency theory and complemented by the stakeholder perspective, as representatives of the stakeholders, the independent non-executive directors are perceived as a tool for monitoring management behaviors resulting in more information disclosure, while the size of the board refers to the number of directors who serve on the board as important corporate governance mechanism has been a subject of theoretical debate. According to agency theory the larger board has greater monitoring capacities. Thus, is regarded as an effective governance tool in monitoring management's performance. According to Welford (2007) stated the large boards are more likely to have greater representation of experienced independent directors Hence, are more likely to reduce management opportunism by diverting attention to corporate performance. From a stakeholder perspective, Sun et al. (2010) argued that larger boards increase the diversity of the board composition, a larger board size enhances a company's ability to understand and address the diversity of various stakeholders’ interests which ultimately leads to greater transparency and more information disclosure. Boards are traditionally composed of only male members. The presence of women on the board leads to gender diversity. It is generally accepted that female board members are more independent because they are not part of the ‘‘old boys’’ network (Carter et al., 2010). According to Ryan & Haslam (2005), women are more likely to be placed in positions of leadership in circumstances of the downturn. The implication is that the presence of women on the board could be perceived by shareholders that significant change is on the way, and making them more confident in the company’s success, which results in the increase in share price. Diversity, in general, is considered to improve organizational value and performance as it provides new insights and perspectives and provides for representation of different stakeholders for equity and fairness, while the CEO duality refers to the situation when the CEO also holds the position of the chairman of the board, CEO duality based on the perception of agency, theory prefers those different individuals occupy the position of CEO and board chair to reduce the influence of the power of one particular the individual on management and board members. In the end, agency theory is a way to explain relationships between principals and agents, which are at odds and can be brought to alignment through a strict and defined governance structure.

Consequently, the importance of this study it comes up to explore and extend board characteristics literature by providing a new theoretical framework that could help to explain the poor of corporate governance mechanism utilization, it provided the new view to developing a scientific efficient model by providing financially based suggestions about the board characteristics can be better impacted. Likewise, the theoretical contributions of this study try to fill the gap of literature which can be seen through delivering a comprehensive framework that links the board characteristics in the context of the global corporations in particularly the international oil and gas corporations. This is especially valuable since there is a lack of research in this field of earnings management relation. Therefore, this study contributes to the enhancement to an understanding of the status and it might help to create or improves the awareness of the decision makers and shareholders towards improving both of the financial performance and achieving the sustainable performance.

In light of these aspects, this study is set to find out the impact of board characteristics on earnings management. Based on the description earlier, this research consideration in mind, the present study aims to investigate the impact of board characteristics on earnings management in international Oil and Gas Corporation in the world. Organize of this paper will be broken down into Literature review and hypothesis development, research methodology, thus the findings and discussions, and the conclusion.

LITERATURE REVIEW AND HYPOTHESIS DEVELOPMENT

According to Habbash (2010), agency theory is the most popular and has received greater attention from academics and practitioners. Thus, Based on the view of the idea that in a modern corporation there is a separation of ownership (principal), and management (agent), and this leads to costs associated with resolving the conflict between the owners and the agents (Jensen & Meckling, 1976; Eisenhardt, 1989). The fundamental premised of agency theory that the manager’s act out of self-interest and are self-centered, thereby giving less attention to shareholder interests, for example, the managers may be more interested in consuming perquisites like luxurious offices, company cars, and other benefits since the cost is borne by the owners. The managers who possess superior knowledge and expertise about the firm are in a position to pursue self-interests rather than shareholders (owners) interests (Fama, 1980; Fama & Jensen, 1983). This pursuit of self-interests increases the costs to the firm which may include the costs of structuring the contracts, costs of monitoring and controlling the behavior of the agents, and loss incurred due to sub-optimal decisions being taken by the agents. Shareholder interests can clearly be compromised if managers maximize their self-interest at the expense of organizational profitability, i.e., the managers expropriating shareholders’ interests. In essence, the managers cannot be trusted and therefore there is a need for strict monitoring of management by the board, in order to protect shareholder’s interest. Further, in a large corporation with widely dispersed ownership, small shareholders do not have a sufficient payoff to expend resources for monitoring the behavior of managers or agents.

This theory highlighted that the separation of ownership and management increases agency conflicts and costs, including information asymmetry, thereby increasing the self-serving behavior of managers. Therefore, effective control/monitoring mechanisms are needed to reduce such agency conflicts and costs. Research has found that effective corporate mechanisms (Young et al., 2008). To reduce agency conflicts and costs in firms thereby enhancing firm performance. Broadly speaking boards of directors are appointed as an internal monitoring instrument for ensuring effective mechanisms of control, advising and monitoring (Park & Shin, 2004). They should clearly consider multiple constituents in decision making and exhibit accountability and transparency in performing their duties (Ntim & Soobaroyen, 2013). Furthermore, boards of directors have a responsibility to adopt the corporate practices effectively in the firm as they are ultimately responsible for the effective organizational functioning and also better financial performance. In the performance of these responsibilities it can be seen that while some boards are active and others are passive (Wheelen & Hunger, 2013) cited from (Obgbechie, 2012) As highlighted it is possible that these behaviors may be due to boards’ characteristics, characteristics that are backed by the firm’s ownership, legal, regulatory, and social contexts for example in highly concentrated ownership among family managed firms, the majority of board members are often from a given family. Indeed, although board characteristics can be observed from a number of dimensions, in this study employed to consider board independence, board size, and board diversity and CEO Duality. Accordingly, If both parties to the relationship are utility maximizes, there is a good reason to believe that the agent will not always act in the best interests of the principal. The principal can limit divergences from his interest by establishing appropriate incentives for the agent and by incurring monitoring costs designed to limit the irregular activities of the agent. Based on Jenses & Meckling (1976) Managers are mostly motivated by their own personal interests and benefits, and work to maximize their own personal benefit rather than considering shareholders' interests and maximizing shareholders wealth.

To solve this problem or to align the conflicting interests of managers and owners the company incurs controlling costs including incentives given for managers and there must be better monitoring and controlling mechanisms which helps to ensure that managers pursue the interests of shareholders rather than only their own interests. Coleman (2007) represented the following key issues towards addressing opportunistic behavior from managers within the agency theory. Agency theory expects the board of directors to include a large percentage of non-executive directors for effective control. The theory argues that this reduces conflict of interest between managers and shareholders and ensures a board’s independence in monitoring and passing fair and unbiased judgment on management. In the end agency theory is a way to explain relationships between principals and agents which are at odds and can be brought to alignment through a strict and defined the structure. According to agency theory, a larger board has greater monitoring capacities. Thus, is regarded as an effective governance tool in monitoring management's performance. Large boards are more likely to have a greater representation of experienced independent directors, could be perceived by shareholders that significant change is on the way, and making them more confident in the company’s success, suggests that the board of directors fulfills a crucial role in monitoring and controlling managers as well as in solving agency problems. Agency theory is one of the main theories used to explain the positive impact of board gender diversity on firm performance. From the agency theory viewpoint, gender diversity is one of the most important governed mechanisms for companies.

In order to understand more specifically about how earnings management is defined, Earnings Management concept-Earnings management is the practice of manipulating firm’s earnings in order to ensure that financial statement looks better than their original status. The definition of earnings management differs depending on how someone considers the practice of managing earnings, for those who accept the practice of earnings management indicating it is good for the firm; they define earnings management as the means used by managers to improve the financial position of the firm (Healy & Helen, 1999). For those who see earnings management into a negative way considers the practice as manipulation of earnings by management in order to gain out of it or to show that the company is performing while it is not at the expense of the shareholder’s wealth as well as the investors (Ronen & Yaari, 2008: Bergstresser & Phillippon, 2006). Managers may manipulate their earnings via two types of accounting approach, and these are:

1. The accounting choices approach and this approach has two aspects, legal and illegal transactions.

2. Operations decisions (Dianita & Rahmawati, 2011).

Earnings management achieved via operating decisions is notoriously difficult to detect and therefore published research has tended to focus on the former category, the accounting choices approach. Distinguishing between legal and illegal accounting choices is deemed one of the most common difficulties that auditors and accountants face; the reason being that there are many gaps in the accounting standards, GAAP, international auditing standards. This increases the opportunities for managers to manipulate the financial statements to achieve their desired goals, and also it is a daunting task to determine whether transactions are legal or illegal because there is no clear guidance on where this boundary lines. Numerous incentives motivate managers to engage in earnings management. Existing literature on earnings management has discussed these incentives under two headings: opportunistic earnings management and beneficial earnings management. Managing earnings to achieve private incentives (managers’ desirable goals) constitutes opportunistic earnings management, and managing earnings to achieve stockholders’ incentives constitutes beneficial earnings management (Rezaei, 2012; Jiraporn et al. 2008).

The Impact of Board Independence on Earnings Management

Board independence is mainly related to the number of independent directors as explained in the agency theory. According to Jouber et al. (2012) using a sample of 180 firms from both France and Canada between 2006 and 2008, they explore whether the strongest corporate governance mechanism (e.g. board independence) could lead to a mitigation of earnings at management level. In the USA, Anglin et al. (2013) found that an independent board led to a constrained level of earnings management, using a sample of 153 real-estate investment trusts firms between 2004 and 2008. The aforementioned studies have been expanded to study the influence of the independent board on earnings management both before and after adopting IFRS. Callao & Jarne (2010) found that earnings management increased after the adoption of IFRS in Europe, where the discretionary accruals increased in the period following the implementation. They referred this result to be arising from the difference between the local (GAAP) and the international standards (IAS, IFRS), which then leads to the manipulation. Moreover, Marra et al. (2011) found that the independent board, after adopting the IFRS in Italy, has a negative impact on earnings management. Based on Zhu & Tian (2009) examined the effect of CEO compensation and Board characteristics and on firm performance, while adjusting the performance for the effect of earnings management. Results depicted that independent directors formed more effective CG mechanism in China. Again based on Cornett et al. (2008) also reported that CG mechanisms like board independence helped to control earnings management practices. Moreover, Roodposhti & Chashmi (2010) examined the relationship between CG internal mechanisms, CEO duality, board independence, ownership concentration, and earnings management. The results depicted the negative impact of ownership concentration, board independence and CEO duality on earnings management, As well as Chekili (2012) examined the effect of CG on earnings management and proved that presence of external directors had a significant relationship with earnings management. Confirmed by Siam et al. (2014) investigated the impact of Board characteristics on earning, whereby Board characteristics included board size, board independence, board meetings, CEO duality and financial expertise of Board. Results concluded that effective board reduced earnings management i.e. board independence, size, meetings, and financial expertise played a significant role in constraining earnings management.

According to Iraya et al. (2015) examined the relationship between CG mechanisms and earnings management. Results indicated the negative relationship between board size, board independence and ownership concentration with earnings management. Talbi et al. (2015) did study to investigate the efficacy of board characteristics in restraining management’s earning management, whereby results showed that board independence played a significant role in controlling earnings management. According to Man & Wong (2013) while conducting the review of the literature on earnings management and CG, reported that board independence increased the control of management’s earning management activities. Over again Sukeecheep et al. (2013) explored the influence of board characteristics on earnings management behaviors and reported that board independence showed a positive link with earnings management. On the basis of the above, the study stated the following hypothesis:

H1: The board independence has a significant impact on the reduction of earnings management.

The Impact of Board Size on Earnings Management

In general, when the size of the board is increasing it is expected to reduce the discretionary accruals and improve the financial reporting quality due to the higher degree of inspection and monitoring by the board of directors. According to Fama & Jensen (1983) describe the board of directors as the most important mechanism in the internal corporate governance structure of any firm. From an agency perspective (Kiel & Nicholson, 2003) clarify the larger boards are more likely to be vigilant for agency problems because a substantial number of experienced directors can be deployed to monitor and review management actions. The agency theory perspective also conceives that larger boards support effective monitoring by reducing CEO dominance within the board and they protect shareholders’ interests (Singh & Vinnicombe, 2004). The previous scholars pointed out that larger boards improve the bargaining position of the board with regard to the CEO and thus larger boards are more effective in monitoring the management. While Maria & Alves (2011) examined empirically how board structure affects the magnitude of earnings management for companies listed in Portugal. The results support the predicted non-linear relationship between board size and earnings management. It is also found that discretionary accruals are negatively related to board composition.

According to Abed et al. (2011) investigated the effect of various CG mechanisms on earnings management and found that only board size had a significant role in containing earnings management. Moreover, Chekili (2012) examined the impact of CG mechanisms on earnings management and found the significant relationship of earnings management with board size, the presence of external directors on the board. Furthermore, Soliman & Ragab (2013) examined the effect of an independent board of director’s members, board size and CEO duality on earnings management, whereby results proved negative relation of board size with earnings management. Siam et al. (2014) explored the relationship between board characteristics and earning management, using board characteristics. Results supported the role of an effective board to reduce earnings management i.e. independence, financial expertise board, board size, and board meetings. Aygun et al. (2014) studied the impact of the size of the board and corporate ownership on earnings management and found the negative relationship of institutional ownership and board size on earnings management. Talbi et al. (2015) study investigated the effectiveness of board characteristics in limiting earnings management. Empirical results depicted the positive impact of board size on earnings management. Although Iraya et al. (2015) studied the impact of CG practices on earnings management and found a negative impact of board size on earnings management, this discussion above led to investigate in the following Hypothesis 2.

H2: The board size has a significant impact on the reduction of earnings management

The Impact of Gender Diversity on Earnings Management

According to Gulzar & Wang (2011) describe that the studies evidence the emergence of an issue of board sex diversity in corporate governance literature started in the last few years. Several studies have recently focused that the female member of the board can affect the firms? performance. However, some studies proposed that board gender diversity has no worthy effect on firm performance. Carter et al. (2003) argue that women may improve decision making of the board. While Fondas & Sassalos (2000) argue that heterogeneous board is more efficient than the homogenous board. Moreover, Omoye & Eriki (2014) conducted research in Nigerian quoted companies into high and low earnings management levels and also to examined how corporate governance mechanisms related to these categories of earnings management levels. The research uncovers that companies would rather use high earnings management practices, and that board gender representation had an unfavorable and significant influence on the likelihood of firms adopting absolute high earnings management.

Based on Hili & Affes (2012) empirically test the impact of gender diversity of the Board of Directors on earnings and on earnings management by using a sample of seventy French firms. The result reveals that the enhancement of earnings persistence possibly will not attribute to gender diversity that is gender diversity does not have a significant impact on whether positive or negative on earnings management. Correspondingly, Carter et al. (2010) investigated the relationship between the number of women directors and the number of ethnic minority directors on the board and financial performance. They find no significant relationship between the gender and ethnic diversity of the board and financial performance for a sample of major US Corporation.

Later Lakhal et al. (2015) examined the effect of gender diversity in board and top-level management positions on earnings management, whereby results depicted that increase in the percentage of women directors in board lead to the reduction in earnings management. Man & Wong (2013) conducted a review of the literature on CG and earnings management and supported the positive role of CG in earnings management. Among other findings, they reported that female directors were more risk-averse towards earning management and frauds. Moreover, Wei & Xie (2016) examined the relationship between CFO gender and earnings management by using a sample of publicly traded firms from 1999 to 2006. The study finds that male CFOs engage more earnings management than female CFOs. It also reveals that female CFOs are more risk-averse in making financial reporting and operational decisions than male CFOs. Furthermore, (Peni & Vähämaa, 2010) examine the association between gender, firms’ executives and Earnings Management for a sample of 500 Finland companies. Panel regression of discretionary accruals is used. The result provides huge evidence to advocate that firms with female directors are connected with income-declining accruals. This implies that females are following more conservative Earnings Management strategies. The result of the empirical analysis indicates that the gender of the firms’ executive may effect on financial reporting. In addition, Srindhi & Tsui (2011) investigate the relationship between female participation and corporate boards and earnings quality drawn from United States-listed firms from 2007 till 2011. They employ two measures of earnings quality: discretionary accruals and tendency of firms to beat earnings benchmark by the little amount. The result of the study shows that the presence of female directors in monitoring position on audit and corporate governance committees makes more transparent reporting and earnings. It also uncovers a significant relationship between female contribution in corporate boards and earnings quality. Furthermore, after controlling for endogeneity, and other firms and industry characteristics, the result still shows a higher earnings quality in firms with female board participation. Again Niskanen et al. (2009) revealed that earnings quality is significantly associated with gender diversity in corporate management. In addition, Ghazaleh & Garkaz (2015) examine the relationship between the existences of women on the boards of directors of companies in Tehran Stock Exchange, earnings management with discretionary accruals index. The required information was taken from 90 accepted firms, for the seven years period from 2006 till 2012. The findings of the study referred that the existence of female directors on the board is significantly and associated with earnings management. It was made clear that firms with the female on their boards, they have lower use of discretionary accruals for earning management.

Nevertheless, Moradi et al. (2012) investigated the significance of board characteristics in reducing earnings management, whereby they reported that gender diversity had no relationship with earnings management. Again based on (Obigbemi et al. 2016) attempted to assess the role board structure plays in curtailing earnings management practices in Nigerian companies. The study samples the data of 137 taken from companies in Nigeria for a period of eight years (2003- 2010). Earnings management was measured using the magnitude of the discretionary accruals as estimated by the performance matched modified Jones Model. The study stated that there is a negative significant relationship between board genders with earnings management. Therefore, Sun et al. (2011) investigate whether female directors represented on the independent audit committees affect the ability of the committees in constraining Earnings Management. Using 525 firm-year remarks for 2003 till 2005, the study did not find any significant association between the proportions of female directors on audit committees and extent of earnings management. Also, O’Reilly & Main (2012) examined the effect of women outside directors on firm performance and CEO compensation. Using a sample of over 2000 firms for the period 2001 to 2005, The result shows no evidence that adding women outsiders to the board enhances corporate performance. Similar with, Hili & Affes (2012) empirically studied the impact of gender diversity of the Board of Directors on earnings quality and on earnings management by using a sample of 70 French firms. The result revealed that the enhancement of earnings persistence could not attribute to gender diversity that is gender diversity does not have a significant impact on whether positive or negative on earnings management.

The study discovers that women are often select to leadership positions under problematic organizational conditions connected with the greater risk of failure and criticism, however, having more women on corporate board and top management does not seem to generate a significant excess return and cannot restrained managers’ opportunistic behavior. This debate led to assume the third hypothesis which is:

H3: The gender diversity has a significant impact on the reduction of earnings management.

The Impact of CEO Duality on Earnings Management

According to the chairman of a company is an individual who is responsible for the effective operation of the board She/he sees to it that the board members are effectively constituted and that they carry out their responsibility as expected, whereas the CEO is an individual who is responsible for the effective operation of the day-to-day activities of the company. These two have the power to make major decisions in the company that may affect the company positively or negatively (Obigbemi et al., 2016. Abdul Rauf et al. (2012) reported a negative impact of management ownership and a positive impact of CEO duality on earnings management (measured by discretionary accruals). Furthermore, Chekili (2012) examined the impact of CG mechanisms on earnings management and found a significant relationship of earnings management with board size, the presence of external directors in the board and CEO duality. Mohammad et al. (2012) examined the significance of CG in controlling earnings management in government-linked firms and found a positive relationship between CEO duality on earnings management. Again, Yugroho & Eko (2011) reviewed the effect of board characteristics (CEO duality, independent board of directors, managerial ownership, board size, multiple directorships, audit committee, board tenure, and board interlock) on earning management and found that CEO duality affected the earning management practices.

Consequently, Siam et al. (2014) investigated the impact of board characteristics on earning management. Their results concluded that effective board reduced earnings management i.e. board independence, size, meetings, and financial expertise played a significant role in constraining earnings management, whereas CEO duality had a positive impact on earning management. Moreover, Iraya et al. (2015) explored the effect of CG practices on earnings management and found a negative impact of ownership concentration, board size, and board independence while positive impact of CEO duality and board activity on earnings management. Correspondingly, Latif & Abdullah (2015) investigated the significance of ownership structure, board characteristics and audit committee characteristics in controlling earning management practices. Results depicted positive relation of CEO duality and institutional ownership with earnings management. Again, Roodposhti & Chashmi (2010) examined the effect of CG, CEO duality and ownership concentration on earnings management in Tehran. For the study, they used a sample of 196 companies listed on the Tehran Stock Exchange, covering the data from the year 2004 to 2008. While controlling for firm size and leverage, panel data analysis revealed the negative significant connection between ownership concentration, board independence and CEO duality with earnings management. Results also depicted a positive relationship of control variable (leverage and firm size) with earnings.

In addition, Soliman & Ragab (2013) examined the effect of CEO duality on earnings management, whereby results proved positive relation of CEO duality and the negative relation of board size, with earnings management. Wang et al. (2010) examined the impact of board characteristics and composition earnings management on fraud, using data for the period 1999 to 2004 covering a sample of fraudulent companies listed on SEC and OTC in Taiwan. 89 fraudulent companies were identified by searching the Commercial Times and Taiwan-based Economic Daily News while pointing at firms that had been convicted by the courts of fraudulent financial reporting. Moreover, 89 non-fraudulent companies, as reported in the above referred financial media and matched according to SIC codes in the same industry, were also selected. Thus, the total of 178 samples was applied in the study. Results depicted that discretionary working capital accruals had a negative effect on fraud. The finding also revealed no influence of CEO duality and Institutional director holding on fraud before the act of the independent directors and auditor, but CEO duality and Institutional director had a negative effect on fraud afterward. In spite of Roodposhti & Chashmi (2010) examined the effect of CG, board independence, CEO duality and ownership concentration on earnings management in Tehran. For the study, they used a sample of 196 companies listed on the Tehran Stock Exchange, covering the data from the year 2004 to 2008. While the data analysis revealed there negative significant CEO duality with earnings management. In addition, Agency theory prefers those dissimilar individuals occupy the position of CEO and board chair to reduce the influence of the power of one particular the individual on management and board members. In the end, agency theory is a way to explain relationships between principals and agents, which are at odds and can be brought to alignment through a strict and defined governance structure. Based on that the fourth hypothesis will be:

H4: The CEO Duality has a significant impact on the increase of earnings management.

RESEARCH METHODOLOGY

The aim of correlation research design is to examine the relationship between both independent and dependent variables (Hair et al., 2010). In order to find out the impact between different variables, and this study employs a quantitative method, the data analyzed using structural equation modeling based smart Partial Least Squares (PLS) through the use of the econometric model, which is means econometric models are statistical models used in econometrics. An econometric model is an earmark for the statistical relationship that is believed to hold between the various economic quantities pertaining to a particular economic phenomenon under study.

The population of this study is the general international corporation in the world, selected from the top 250 ranking in 2016 based on S&P global platts. We selected the seventy-one (71) international corporations which have been chosen from oil and Gas Corporation. The data for this research using secondary data, such as Annual Reports, and financial statements. The corporations draw from Corporation of oil and gas exploration corporations. The main reason for chosen international corporations of Oil and Gas because it includes a broad range of industries and accounts for a significant portion of the economic output, which in turn ensures that the sample is large enough for the statistical procedures to be conducted.

Operational Definition and Measurement Variables

Based on Sekaran (2003:27) defined operational definition as a concept made to be measured by considering the behavior dimensions, aspect, or property signified by the concept. Hair et al. (1998) explain the operational definitions of variables is defined based on the traits that can be observed so that it can be determined the appropriate data retrieval tool for use. The conceptual definition is the definition given to the variables that research can be interpreted differently than the one referred to the study. While the operational definition describes how research can be measured through variable items that have been there. To limit the problems in this research, operational definitions need to be made for each of the variables examined. The operational definition is used to determine and measure the variables by formulating briefly and clearly, so it will not raise different interpretation, The definition research variables operationally in this study consists of five variables construct, namely:

1. Board independence (Independent variable).

2. Board size (Independent variable).

3. Gender diversity (Independent variable).

4. COE duality (Independent variable).

5. Earnings management (dependent variable).

Board Independence (Bind)

Board independence is measured by the percentage of the independent directors to the total number of directors on the board. The board of directors’ generally consists of dependent and independent members. Dependent members either have direct responsibility for business management. On the other hand, independent members basically represent the interests of minor shareholders since they are not directly involved in firm activities and their only affiliation with the firm is their directorship.

Board Size (BI)

Board size indicates the total number of directors on the board of each sample firm which is inclusive of the CEO and Chairman assigned for each accounting year. The number of directors' sits on the board will use a proxy for this variable.

Gender Diversity (GD)

Gender diversity is the proportion of the number of female to total board size is used as a measure of board gender. The presence of a female on the board leads to gender diversity. It is generally accepted that female board members are more independent (Carter et al., 2003).

CEO Duality (CEO)

CEO duality has been received great attention in the corporates management. The prediction that a corporation with dual leadership structure may hinder their performance. The leadership structure is measured by a dummy variable which is denoted as “1” If the CEO is also the chairperson of a company and as “0” otherwise.

Earnings Management (EM)

Earnings management is the practice of manipulating firm’s earnings in order to ensure that financial statement looks better than their original status, as evident from the review of the literature most of the researchers have used accruals as a proxy for earnings management. In this regard, there are two approaches to measuring accruals:

1. Balance sheet approach.

2. Cash flow statement approach.

As highlighted by Shah et al. (2009) also, in weighing both approaches, the majority of the researchers in the past have preferred cash flows approach. For instance, Collins & Hriber (1999) also supported the use of cash flows based approach for calculation of total accruals. Keeping in view the same, cash flow based approach has been employed for calculation of total accruals as per following equation:

TAt=N.It–CFOt

Where,

Tat=is equal to total accruals in year t.

N.It=is equal to Net Income in year t.

CFOt=is equal to cash flows from operating activities in year t.

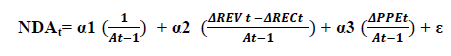

Discretionary Accruals As evident from the studies of previous researchers, there are two types of accruals (discretionary and non-discretionary accruals), However, managers involved in earnings management by playing with discretionary accruals. In this regard, the researchers had applied various models for calculation of discretionary accruals e.g. DeAngelo Model in 1986, Healy Model in 1985, Jones Model in 1991 and Modified Jones model in 1995. However, the latest and widely used model is Modified Cross-Sectional Jones Model, which has been used in this study also, wherein discretionary accruals have been derived by subtracting nondiscretionary accruals from total accruals, whereby non-discretionary accruals are derived as under:

Where,

ΔREVt=is equal to revenues in year t less revenue in year t-1.

ΔRECt=is equal to net receivables in year t less net receivable in year t-1.

ΔPPEt=is equal to gross property plant and equipment at the end of year t.

At-1=is equal to total assets at the end of year t-1.

α1, α2, α3 are firm-specific parameters.

ε is the residual.

Total accruals derived from cash flow based approach have been regressed on the difference between the change in revenue and change in receivable (in the current year) and change in property, plant, and equipment (current year), for calculating α1,α2,α3 as shown in the equation. Subsequently, coefficient values have been adjusted in the said equation to derive nondiscretionary accruals. Lastly, the discretionary accruals have been derived by subtracting nondiscretionary accruals from total accruals, as shown below Table 1.

| Table 1 VARIABLE, INDICATORS AND MEASUREMENT |

||

| Variables | Indicators | Measurements |

| Board independence |

Independent directors. | The percentage of independent directors of the total number of directors on the board of a company. |

| Board size | Directors sit on the board. | Total number of directors sit on the board. |

| Board diversity | The number of women to total board size. | The ratio of the number of women to total board size. |

| CEO Duality | CEO duality indicate to the case when the CEO also holds the position of the chairman of the board. | Dummy variable which is denoted as “1” If the CEO is also the chairperson of a company and as “0” otherwise. |

| Earnings management | The value of discretionary accruals. | Discretionary Accruals (as a proxy for earnings management). |

DA=TA-NDA

DA=is equal to the discretionary component of accruals.

TA=is equal to total accruals.

NDA=is equal to nondiscretionary accruals.

FINDINGS & DISCUSSION

Evaluation Model

The Model evaluation in this research with model predictions using Partial Least Squares (PLS) to estimate parameters and predict relationships of causality, by evaluating the outer model and inner model.

Evaluation of the model is done with three stages, namely the testing of convergent validity, testing of discriminant validity, and the testing of reliability.

Convergent Validity

Assessment in convergent validity testing is based on the value Average Variance Extracted (AVE), commonality, and the value of factor loading. Rule of thumb for parameter Average Variance Extracted (AVE) and commonality is more than 0.50, and more than 0.70 for the value of factor loading. Hair et al. (2006) in Hartono & Abdillah (2009) stated that the rule of thumb that is typically used to make the initial examination of the matrix factor, where ± 0.30 is considered as having met the minimum level, for loading ± 0.40 is considered better, and for loading>0.50 is considered significantly practical. These values can be determined based on the Tables 2 & 3 above. Based on the table above, it can be seen the value AVE and Communality in each construct is more than 0.5. Similarly, the outer loading test results in the Table 3 Outer Loading above, all indicators value is above 0.7. Thus, based on the processing results, it can be concluded that the convergent validity has been met. The next step after the author measures the convergent validity, the author measures the discriminant validity.

| Table 2 TABLE OF ALGORITHM |

|||||

| Construct | AVE | Composite Reliability | R-Square | Cronbachs Alpha | Communality |

| BI | 0 | 0 | 0 | 0 | 1 |

| BS | 0 | 0 | 0 | 0 | 1 |

| CEO | 0 | 0 | 0 | 0 | 1 |

| GD | 0 | 0 | 0 | 0 | 1 |

| EM | 0 | 0 | 0.7389 | 0 | 1 |

| Table 3 OUTER LOADING |

|||||

| BI | BS | CEO | EM | GD | |

| BI | 1 | ||||

| BS | 1 | ||||

| CEO | 1 | ||||

| EM | 1 | ||||

| GD | 1 | ||||

To measure the Discriminant Validity, the researcher must assess the Cross Loading value. If the value of one particular variable or construct were more than 0.7, then it would be accepted. Based on the Cross Loading Table 4 below, it is concluded that if the discriminant validity is met for each indicator in each variable over 0.7 despite the same conditions as the previous loading factor assessment, there is a value of less than 0.7 but still considered valid because the variable has value more than 0.5. After the researcher completed this phase, the next step is called for Reliability Testing. Reliability test can be done in two methods: Cronbach's Alpha value, whose value must be more than 0.6, and Composite Reliability value, that should be more than 0.7. According to algorithm all variables have the value of Cronbach's Alpha is more than 0.6 and Composite Reliability values are more than 0.7. Hence, it can be concluded that the data and the results of measurements are considered reliable. The test results of convergent validity, discriminant validity, and reliability.

| Table 4 CROSS LOADING |

|||||

| BI | BS | CEO | EM | GD | |

| BI | 1 | 0.3771 | -0.4305 | 0.6535 | 0.5266 |

| BS | 0.3771 | 1 | -0.3589 | 0.5453 | 0.5398 |

| CEO | -0.4305 | -0.3589 | 1 | -0.5967 | -0.4388 |

| EM | 0.6535 | 0.5453 | -0.5967 | 1 | 0.69 |

| GD | 0.5266 | 0.5398 | -0.4388 | 0.69 | 1 |

Goodness of Fit Model

Structural model in PLS was evaluated using R-square for the dependent constructs. R2 Value is used to measure the degree of variation of the independent variable changes in the dependent variable. The higher R2 value indicates better predictive models of the proposed research model

The coefficient of determination is used to calculate the influence or contribution of independent variable toward the dependent variable. From the analysis of Table 5, we got the result of R2 is 0.7389. Means that 73.89% Earnings management results variable will be influenced by another independent variable which is: Board Independence, Board size, Gender Diversity, COE Duality. Whereas another 26.11% of Earnings management results variable will be influenced by another variable undescribed in this study.

| Table 5 R-SQUARE VALUE |

|

| Variable | Chi square value |

| EM | 0.7389 |

The goodness of Fit Model is measured using the R-square dependent latent variable with the same interpretation to the regression. Q2 predictive relevance for the structural model measures how well the observed value generated by the model has predictive relevance, conversely if Q2 value ≤ 0 indicates the model lacks predictive relevance. The Q2 calculation is done using the formula

Q2=1–(1–R2)

Q2=1–(1–0.7389)

= 0.7389

Q2 value from calculating is 0.7389 it means variability of data research can be explained the structural model is 73.38%, whereas another 26% will be influenced by another variable undescribed in this study. Based on this result, the structural model in this study has good goodness of fit.

HYPOTHESES TESTING

fter a test of convergent validity, discriminant validity, and reliability testing, the next is hypothesis testing. Based on the data processing, the form of Total Effects is shown in Table 6. In hypothesis testing, if the coefficient path shown by the t-statistic is more than 1.96 or pvalue< 5% (0.05), then the alternative hypothesis can be stated as supported. Nevertheless, if the statistical value of T-statistic is less than 1.96 or p-value>5% (0.05), then the alternative hypothesis is not supported. From processing the data in Direct Effects Table 6 can be seen that the T-statistic for each construct and determine whether or not the hypothesis is supported.

| Table 6 T TEST FOR DIRECT IMPACTS |

||||

| Construct | Estimate value | t test | p-Value | Note |

| BI -> EM | 0.2908 | 3.491 | 0.001 | Significant |

| BS -> EM | 0.0543 | 0.7228 | 0.472 | Not Significant |

| GD -> EM | 0.3097 | 3.468 | 0.001 | Significant |

| CEO -> EM | -0.2279 | 3.5107 | 0.001 | Significant |

Based on Table 6 can be writing the equation model:

EM=0.2908 BI+0.0543 BS+0.3097 GD–0.2279 CEOD

Hypothesis 1: The board independence has a significant impact on the reduction of earnings management.

The result hypotheses testing between Board independence and the earnings Management indicates T-test is 3.491. While T-table is 1.96. Because T-test>T-table that is 3.491>1.96 or pvalue (0.000)<α=0.05 then influence of X1 (Board independence) toward earnings Management results is significant. Means, reject H0 and accept H1. It indicates that Board independence affects the earnings management. Based on the results, it can be stated that Hypothesis 1 is supported.

Hypothesis 2: The board size has a significant impact on the reduction of earnings management.

The result hypotheses testing between board size and the earnings Management indicates T-test is 0.7228. While T-table is 1.96. Because T-test<T-table that is 0.7228<1.96 or p-value (0.472)>α=0.05 then influence of X2 (board size) toward earnings Management results is not significant. Means, accept H0. It indicates that board size does not affect the earnings management. Based on the results, it can be stated that Hypothesis 2 is not supported.

Hypothesis 3: The gender diversity has a significant impact on the reduction of earnings management.

The result hypotheses testing between gender diversity and the earnings Management indicates T-test is 3.468. While t-table is 1.96. Because T-test>T-table that is 3.468>1.96 or pvalue (0.001) <α=0.05 then influence of X3 (gender diversity) toward earnings Management results is significant. Means, reject H0 and accept H1. It indicates that gender diversity affects earnings management. Based on the results, it can be stated that Hypothesis 3 is supported.

Hypothesis 4: The CEO Duality has a significant impact on the increase of earnings management.

The result hypotheses testing between CEO Duality and the earnings Management indicates T-test is 3.5107. While T-table is 1.96. Because T-test>T-table that is 3.5107>1.96 or p-value (0.001)<α=0.05 then influence of X4 (CEO Duality) toward earnings Management results is significant. Means, reject H0 and accept H1. It indicates that CEO Duality affects the earnings management. Based on the results, it can be stated that Hypothesis 4 is supported.

DISCUSSION

The objective of this study is to test and analyses the research questions, and based on hypothesis tested and findings in this study revealed that has the relationship in examining board characteristics such as (board independence BI, board size BS, and gender diversity GD, and CEO duality CEOD), on earnings management EM. Based on these results the conducting a finding of validity to seek an explanation for the result tested for both a direct effect. The validity of discoveries made by searching related journals to support the statement that has been disclosed previously.

The result showed that the testing of the Hypothesis 1 which stated that the board independence has a significant impact on the reduction of earnings management is showing a significant. It can be said that the board independence has a reduction impact on earnings management, which this finding consistent with the agency theory. In the agency theory, it is stated that separation of control and ownership results in the divergence of interests among the shareholders and managers, which warrants close monitoring of managerial decisions by board independence to ensure that the interest of shareholders is secured while ensuring transparency in financial reporting. Therefore Board independence play a vital role in monitoring and disciplining the management, ensuring that managers’ pursuit of objectives is aligned with the shareholder's interests. As such, Board independence plays a pivotal monitoring role in evaluating and ensuring reliability. The finding is similar to the previous studies of Board independence is mainly related to the number of independent directors as explained in the agency theory. Park & Shin (2004) study the effect of the board on earnings management and set up that non-executive directors assist to control earnings management and have a slight abnormal accrual. Dechow et al. (1996) set up that firms with a large percentage of no executive members are a smaller amount likely to be subject to accounting enforcement actions for claimed GAAP violations. Mather & Ramsay (2006) explored the effectiveness of a few Board characteristics in controlling earnings management by Australian companies who changed CEO. Evidence revealed a significant role of board independence in restraining earnings management practices. Zhu & Tian (2009) examined the effect of Board characteristics and on firm performance while adjusting the performance for the effect of earnings management. Results depicted that independent directors formed more effective CG mechanism in China. Cornett et al. (2008) also reported that CG mechanisms like board independence helped to control earnings management practices.

The results showed that the testing of the Hypothesis 2 which states that the board size has a significant impact on the reduction of earnings management. The statically test between the board size and the earnings management indicates is not significant. It can conclude this hypothesis is not supported. This result confirms the previous studies by Ahmed et al. (2006) found a negative effect of board size on earnings management. Furthermore, Soliman & Ragab (2013) examined the effect of the independent board of director’s members, board size on earnings management, whereby results proved a negative relation of board size with earnings management. In addition Iraya et al. (2015) studied the impact of CG practices on earnings management and found a negative impact of board size on earnings management. However, Aygun et al. (2014) studied the impact of the size of the board and corporate ownership on earnings management and found a negative relationship between institutional ownership and board size on earnings management.

In addition, this finding different with Chekili (2012) examined the impact of CG mechanisms on earnings management and found a significant relationship of earnings management with board size, the presence of external directors in the board. Moreover, Talbi et al. (2015) did study to investigate the effectiveness of board characteristics in limiting earnings management. Empirical results depicted the positive impact of board size on earnings management. Similarly, Abed et al. (2012) investigated the effect of various CG mechanisms on earnings management and found that board size had a significant role in containing earnings management

The result indicated is not harmonious with the agency theory due to the big board size, the less able to monitoring of the board. When there are more members of the board, it is more complicated for the board members to observe and monitor the management. On the other hand, the size of the board directors is the influential determinants of the monitoring function from the board. Hereby the justification of this hypothesis is not supported because the Board size is important factors that influence the effectiveness of board oversight duties. It is believed that smaller boards are easier to coordinate; quicker in making decisions; less likely to have free-rider problems; and less likely to oppose innovation.

The statistical analysis results reveal the findings of the Hypothesis 3 testing the hypothesis which is stated that gender diversity has a significant impact on the reduction of earnings management indicates is significant. This finding is confirmed the previous finding of Later Lakhal et al. (2015) examined the effect of gender diversity in board and top-level management positions on earnings management, whereby results depicted that increase in the percentage of women directors in board lead to the reduction in earnings management. In comparison with, Man &Wong (2013) conducted a review of the literature on CG and earnings management and supported the positive role of CG in earnings management. Among other findings, they reported that female directors were more risk-averse towards earning management and frauds. As well as Wei & Xie (2016) examine the relationship between CFO gender and Earnings Management. The study finds that male CFOs engage more Earnings Management than female CFOs. It also reveals that female CFOs are more risk- reluctant in making financial reporting and operational decisions than male CFOs.

Likewise, (Peni & Vähämaa, 2010) examine the relationship between gender, firms’ executives and Earnings Management. The result provides great evidence to suggest that firms with women directors are associated with income-declining accruals. This implies that females are following more protective Earnings Management strategies. The result of the empirical analysis indicates that the gender of the firms’ executive might affect the quality of financial reporting. Moreover, Gulzar & Wang (2011) explore the efficiency of corporate governance characteristics in reducing Earnings Management in listed firms of Shanghai and Shenzhen stock exchange in China. The result indicates that the existence of a female director in the board assists to decrease the level of earnings management.

Besides, Srindhi & Tsui (2011) investigate the relationship between female participation and corporate boards and earnings quality drawn from US-listed firms from 2007 to 2011. The result of the study shows that the presence of female directors in monitoring position on audit and corporate governance committees makes more transparent reporting and earnings quality. It also reveals a positive relationship between female participation in corporate boards and earnings quality. Furthermore, Niskanen et al. (2009) reveals that earnings quality is positively associated with gender diversity in corporate management. Furthermore, Ghazaleh & Garkaz (2015) examine the association between the existence of female on the boards of directors of listed companies in Iran, using and earnings management. The results of the study indicate that the existence of women directors on the board is significantly and linked with earnings management. It was made apparent that firms with women on their boards, they have less exercise discretionary accruals for earning management.

Conversely, this finding is different with other researchers, for instance, Moradi et al. (2012) investigated the significance of board characteristics in reducing earnings management, whereby they reported that gender diversity had no relationship with earnings management. Again based on (Obigbemi et al. 2016) tried to study the role board structure have curtailing earnings management practices. The research claimed that there is a negative significant relationship between board genders with earnings management. Similarly, Sun et al. (2011) investigate whether women directors represented on the independent audit committees affect the ability of the committees in constraining earnings management. Using 525 firm-year observations for years 2003 to 2005, the study did not reveal any significant association between the proportions of women directors on audit committees and extent of Earnings Management.

Again and more specifically, Rose (2007) discovers that no significant association between women board representation and corporate performance. Likewise, Springer (2008) analyzed whether and how the participation of women in the corporation board of directors and senior management do not increase corporation financial reporting quality or ability to checkmate opportunistic behavior of management. The result revealed that women are often appointed to leadership positions under problematic organizational circumstances associated with greater risk of failure and criticism, however, having more women on corporate board and top management does not seem to create a significant over return and cannot restrict managers opportunistic behaviors.

In summary, the finding of this hypothesis is asserted what is the agency theory suggested that higher gender diversity made a better control mechanism between the boards and management via boost independence and great monitoring system this is because gender diversity increases creativity and innovation in firms which is considered as valuable. Besides, female directors are clever to recover the firms’ performance through the reduction of opportunistic earning management, because women directors are said to be less permissive of opportunistic behavior, hence reduce the conflict between the boards and the managers.

The result showed that the testing of the Hypothesis 4 which states that The CEO Duality has a significant impact on the increase of earnings management, the result of hypothesis testing between CEO Duality and the earnings Management is significant. This finding not consistent with previous studied like, Soliman & Ragab (2013) examined the effect of CEO duality on earnings management, whereby results proved not reducing the earnings management. Moreover, Saleh et al. (2005) assessed the significance of the board of director characteristics towards controlling earnings management by the manager and found that CEO duality had a positive effect on earnings management. Obviously, Therefore, Moreover, Iraya et al. (2015) explored the effect of CG practices on earnings management and found a positive impact of CEO duality on earnings management. Latif & Abdullah (2015) investigated the significance of ownership structure, board characteristics and audit committee characteristics in controlling earning management practices. Results depicted positive relation of CEO duality with earnings management.

In other words, this finding consistent with previously studied like Abdul Rauf et al. (2012) reported negative impact of management ownership and a positive impact of CEO duality on earnings management (measured by discretionary accruals). Roodposhti & Chashmi (2010) examined the effect of CG, CEO duality and ownership concentration on earnings management in Tehran. For the study, they used a sample of 196 companies listed on the Tehran Stock Exchange, covering the data from the year 2004 to 2008. While the data analysis revealed that there significant impact of CEO duality on earnings management. Furthermore, Chekili (2012) examined the impact of CG mechanisms on earnings management and found a significant relationship between earnings management and CEO duality. Similarly, Mohammad et al. (2012) examined the significance of CG in controlling earnings management in government-linked firms and found a positive relationship between CEO duality on earnings management. Likewise, Yugroho & Eko (2011) reviewed the effect of board characteristics (CEO duality) on earning management and found that CEO duality affected the earning management practices.

In the end, this finding is consistent with agency theory holds that different individual impedes the overall stakeholder orientation of board members, Agency theory emphasizes that the split of the task of CEO and Chair of the Board might improve the Board of Directors’ monitoring and control ability, and improve directors’ information processing capacities. Agency theory prefers those different persons hold the position of CEO and board chair to decrease the influence of the authority of one particular the individual on management and board members. In the end, agency theory is a way to explain relationships between principals and agents, which are at odds and can be brought to alignment through a strict and defined governance structure.

CONCLUSION

The core objective of this study is to inspect and examine the board characteristics impacts on earnings management, more precisely the authors try to provide an answer to the following question: Do board characteristics such as (board independence, board size, and gender diversity, and CEO duality) have an impact on earnings management? Firstly the study revealed that the board independence has a considerable impact on the reduction of earnings management, board independence to ensure that the interest of shareholders is secured while ensuring transparency in financial reporting. Therefore board independence plays a vital role in monitoring and disciplining the management, ensuring that managers’ pursuit of objectives is aligned with the shareholder's interests. Secondly, the board size does not have any impact on the reduction of earnings management, due the larger the board size, the less efficient the monitoring of the board. When there are more members on the board, it is more difficult for the board members to monitor the management. On the other hand, the size of the board directors is the influential determinants of the monitoring function from the board. Hereby the justification of this hypothesis is not supported because the board size is an important factor that impacts the effectiveness of board oversight obligations. It is believed that a smaller board is easier to coordinate; faster in creation decisions; less likely to have free-rider problems; and less probable to oppose innovation. third, The gender diversity has a significant impact on the reduction of earnings management, suggested that higher gender diversity creates a good supervision mechanism between the boards and management via enhancing independence and better monitoring system this is because gender diversity increases creativity and innovation in firms which is considered as valuable. Finally, The CEO Duality has a significant impact on the increase of earnings management, which means the Separating the functions of CEO and chair of the board may improve the board of directors’ monitoring and control ability, and improve directors’ information processing capacities.

The contribution of this study, theoretical it extend the board characteristics literature by providing a new theoretical framework that aids to illuminate the week corporate governance mechanism utilization, it will provide an insight view to developing a scientific model by provide financially based suggestions about the board characteristics can be better impacted as well the theoretical contributions of this study try to fill the gap in literature which can be seen through delivering a comprehensive framework that links the board characteristics on earnings management in the context of the oil and gas corporations in global perspective. This is especially valuable since there is a dearth of research on this ground which is absolutely up to now there is no study links the board characteristics with earnings management relations in global oil and gas corporations.

Practical contribution, provide suggestions that could assist organizations to embrace some ideal form of board characteristics, An overview of the previous literature has indicated a dearth of research status in global oil and gas corporations, and specifically in oil and gas corporations as notable that past studies with regards to the board characteristics on earnings management in the global perspective, Therefore this study contributes to the enhancement of understanding of the status and the impacts of board characteristics on earnings management in global perspective. This study may help to create or improves the awareness of the decision makers companies in the over the world towards improving both of the financial performance and achieving the Sustainable performance via good corporate governance.

The policy contributions of this study likewise, a contribution is made in describing, the board characteristics, in the context of the international corporations this contribution could be useful in the evaluation of the current state of the board characteristics practices in oil and gas corporations to enlighten the governments and local organization to spark the way for them about the issue of corporation performance via investigate the impact of board characteristics and earnings management to impose efficient mechanism which is can be led to the benefits for all the parts of society, environment, and government in over the world. Additionally, a novelty can also be seen in the embodiment of new countries that have not been investigated in this manner before. The results of this research can be applied to other countries that have a parallel status such as high dependence on the oil sector and emphasis on oil resources that are not limited to one part of the year.

References

- Abdul Rahman, R., & Ali, F. (2006). Board, audit committee, culture and earnings management: Malaysian evidence. Managerial Auditing Journal, 21(7), 783-804.

- Abdul Rauf, F.A., Johari, N.H., Bunamin, S.B., & Rahman, N.R. (2012). The impact company and board characteristics and earnings management. Global review of Accounting and Finance, 3(2), 114-127.

- Abed, S., Al-Attar, A., & Suwaidan, M. (2012). Corporate governance and earnings management: Jordanian evidence. International Business Research, 5(1), 216- 225.

- Ahmed, K., Hossain, M., & Adams, M. (2006). The effects of board composition and board size on the informativeness of annual accounting earnings. Corporate Governance: An International Review, 14(5), 418-431.

- Anglin, P., Edelstein, R., Geo, Y., & Tsang, D. (2013). What is the relationship between REIT governance and earnings management. Journal of Real Estate Finance and Economics, 47(3), 538-563.